PORTLAND,

Ore. — The market for micro-electromechanical system (MEMS) chips will

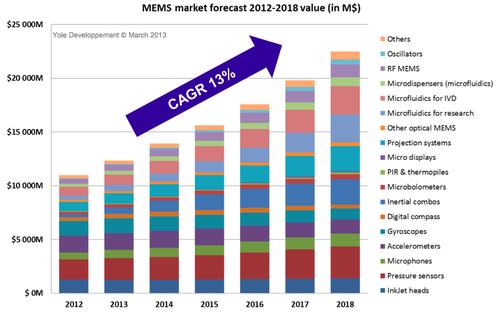

grow from about $12 billion last year to over $22 billion by 2018,

according to market analysts at this week's MEMS Executive Congress US

2013 in Napa, Calif.

More than 250 attended the 12th annual meeting of the MEMS Industry

Group (MIG), which aims to be the "mother ship of all things MEMS,"

according to executive director Karen Lightman who described MIG's

membership as spanning the entire MEMS supply chain -- from device

manufacturers and foundries, to materials and equipment suppliers, to

OEM integrators and software designers.

"Consumer applications are transforming the MEMS industry," according to Laurent Robin, activity leader for Inertial MEMS Devices and Technologies at Yole Development in France, who predicted compound annual growth of 13 percent for the next five years.

The market for MEMS chips will top $22 billion by 2018, according to market analysts at the MEMS Executive Congress.

Click here to enlarge image.

(Source: Yole)

Click here to enlarge image.

(Source: Yole)

"We expect to see increases in number of MEMS devices in mobile platforms, led by more integrated solutions, such as 9-axis sensors," said Robin.

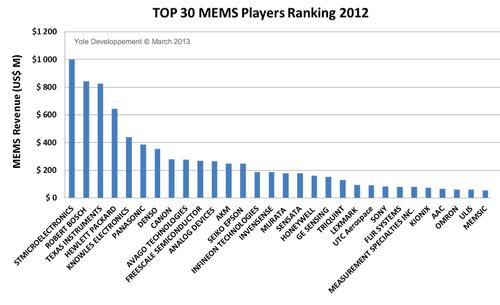

The top MEMS chipmakers include ST, Bosch, TI, and HP, according to analysts at the MEMS Executive Congress.

Click here to enlarge image.

(Source: Yole)

Click here to enlarge image.

(Source: Yole)

IHS disagrees

The next killer applications for MEMS chips, according to Jérémie Bouchaud, director and senior principal analyst for MEMS and sensors at IHS Inc., will be thermal cameras for low-light security photos, gas sensors for everything from breath analysis to air pollution, and micro-speakers -- as Yole predicts.

Bouchaud agreed that handsets and tablets will remain the main growth opportunities for MEMS chips, but added that the market for accelerometer and magnetometers was saturating, with the new MEMS sensor types built on the sensor hub concept keeping the market growing in the future.

"The MEMS market is very dynamic," said Bouchaud, "with new devices coming into the market every year, making forecasting much more risky."

One trend that Bouchaud does not think is risky to predict, however, is that today's market is dominated by "a two-horse race" between Apple and Samsung. However, he predicted that will eventually give way, circa 2015, to a market dominated by a wide variety of Chinese original equipment manufacturers (OEMs), which are growing at a faster rate.

"For the future, Chinese OEMs will be the new battlefield," said Bouchaud.

China OEMs are also serving as a stepping stone for newcomers to the MEMS market, including MEMS autofocus module makers, pico projector makers, and gas sensor makers for handsets. On the negative side, Chinese OEMs act like a cartel, together demanding the lowest prices from vendors by sharing what they pay among themselves -- causing price erosion to accelerate since they need not fear shareholders suing.

Also fading in the overall MEMS market, according to Bouchaud, is the need to "keep up with Apple" by adopting whatever sensor the iPhone and iPad recently added. Instead, today OEMs are waiting for application developers to create viable use-cases, rather than just installing whatever sensor Apple adds. As a result, the explosive growth experienced by MEMS sensor suppliers favored by Apple is no longer leading to market saturation and subsequent price erosion.

No comments:

Post a Comment